Featured

Fca Aml Capital Markets

The concept of money laundering is very important to be understood for these working within the financial sector. It is a process by which dirty money is converted into clean money. The sources of the money in actual are prison and the cash is invested in a means that makes it look like clean cash and hide the id of the prison a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the new prospects or sustaining current prospects the duty of adopting enough measures lie on every one who is part of the organization. The identification of such aspect to start with is easy to take care of instead realizing and encountering such conditions afterward within the transaction stage. The central bank in any nation gives complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to discourage such conditions.

Our findings are likely to be of interest to all firms carrying out business related to the capital markets. Bovills Darby said more AML technology options were becoming accessible to firms.

Analysis Capital Markets Are Vulnerable To Money Laundering Too Here S The Guide To Spotting The Signs Early On Aml Intelligence

Butler said the FCA had a keen interest in the quality of AML systems and controls at firms.

Fca aml capital markets. Investment banks and other firms participating in UK capital markets must do more to understand their potential exposure to money laundering according to the Financial Conduct Authority FCA. In a recent Thematic Review the FCA identifies shortcomings in the approach taken to anti-money laundering in capital markets TR194 link below This follows the guidance on a risk-based approach for the securities sector published by the FATF in October 2018 which is broader in scope link below The focus of the FCA thematic review is on secondary not primary markets and on equities. Wholesale markets capital markets are a core focus for the FCA in its 20192020 Business Plan where cross-sector work covers criminal activity.

In June 2019 the FCA published a report designed to assist firms in identifying and assessing the capital market ML risks they are exposed to. The report discusses money laundering risks unique to financial instrument trading and examples of positive and insufficient regulatory activities. The FCAs report sets out seven examples of typologies of money laundering in capital markets and identifies some of the key risk areas and red flags.

While there is no requirement under the Money Laundering Regulations 2017 to know your customers customer the FCA. In a thematic review published Tuesday the FCA found that most financial. The FCA considers the capital market-specific ML risks to be in particular.

1 This was based on the FCAs thematic review of ML challenges in capital markets transactions and is a topic that globally regulators are paying increased attention to as evidenced by the recent wave of guidance papers issued. The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area. At the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry.

Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from the thematic report are adequately considered. The FCAs 20192020 Business Plan cites wholesale markets capital markets as a key priority where cross-sector work includes financial crime. The FCA came to the following final result.

FCA Outlines Risks of Money Laundering to Capital Markets13 Jun 2019. In particular the first line of defense needs to take greater ownership and accountability of ML risks rather than viewing it as an exclusive responsibility of the second line ie compliance. Lack of visibility of underlying customers most participa nts had limited visibility of their customers customers or the ultimate beneficial owner of traded assets.

The review covered 19 firms representing a broad range of market segments and participants and focused on secondary markets. What you should do. The FCA flagged that generally there is insufficient understanding of firms exposure to money laundering risks in capital markets.

In particular the review found that participants were generally at. Trade bodies and industry groups relating to capital markets may also be interested. In this report we have defined capital markets as financial markets where shares derivatives bonds and other instruments are bought and sold.

12 In this report by capital markets we mean financial markets where shares derivatives bonds and other instruments are bought and sold. Inadequate customer due diligence CDD CDD should focus on effectively identifying the customer by adequately identifying their intended trading strategies. FCA has published its thematic reviewof money laundering risks in the capital markets.

FCA found some risks specific to the markets which were not effectively mitigated by the nature of the firms involved and a lack of. The Financial Conduct Authority FCA recently published its first thematic review on AML in the capital markets industry. Deutsche Banks 163 million fine in January 2017 by the FCA was probably the most high profile example of poor controls in capital markets she said.

The Money Laundering Regulations first came into force in the UK in 1994 and applied to capital markets firms from the outset and yet 25 years later the FCA states in this review W e found that participants were generally. Our focus was assessing the risks. The FCA followed up on the topic again earlier this month when it published a thematic review dedicated to money laundering in capital markets.

Dedicated anti-money laundering AML training is too high level and not tailored enough to inform staff regarding the specific ML risks in capital markets.

Hide And Seek Layering Illicit Funds Via Securities Trading In The Market Acams Today

Countering Money Laundering In Capital Markets In A Recent Thematic Review The Fca Identifies Shortcomings In

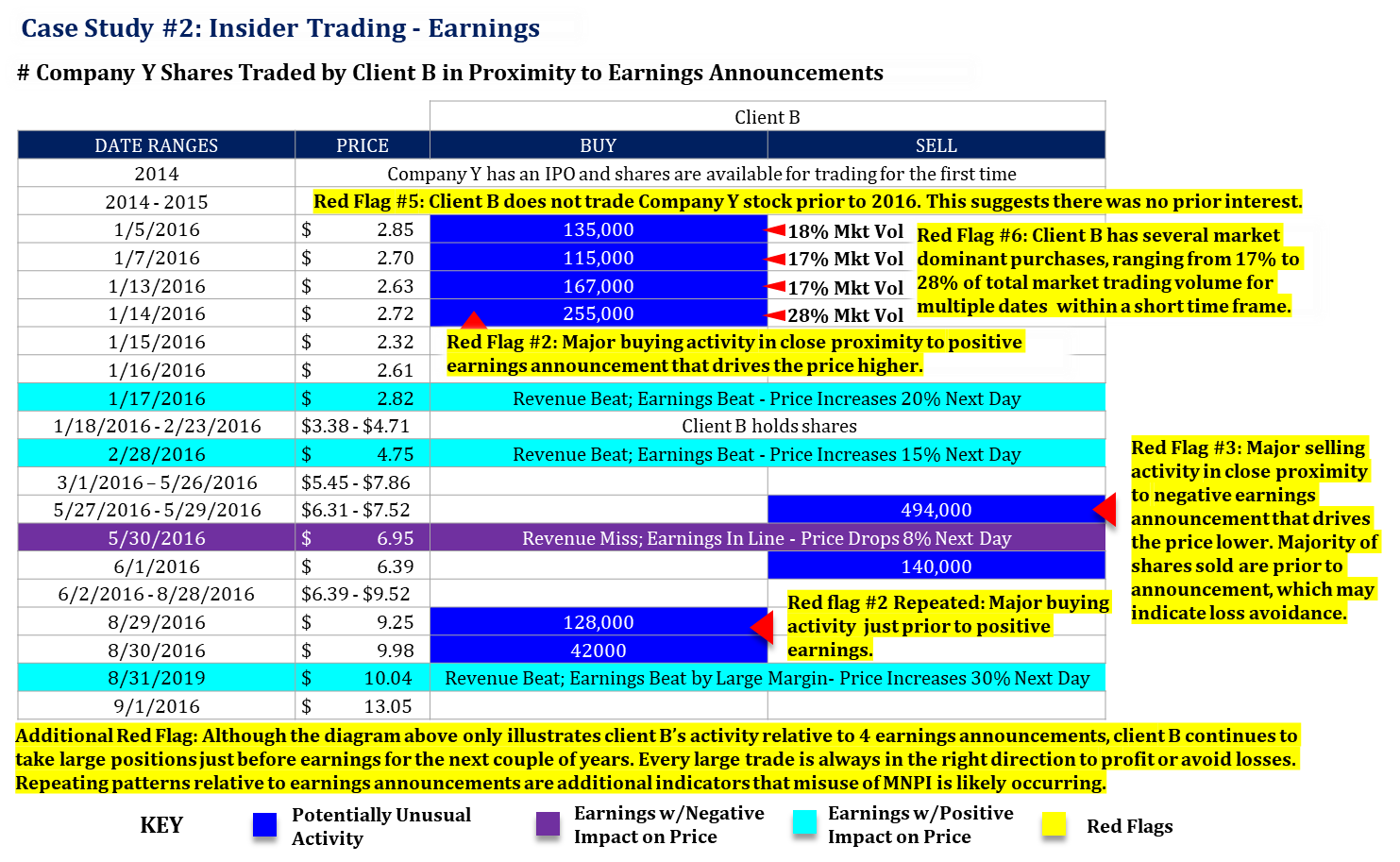

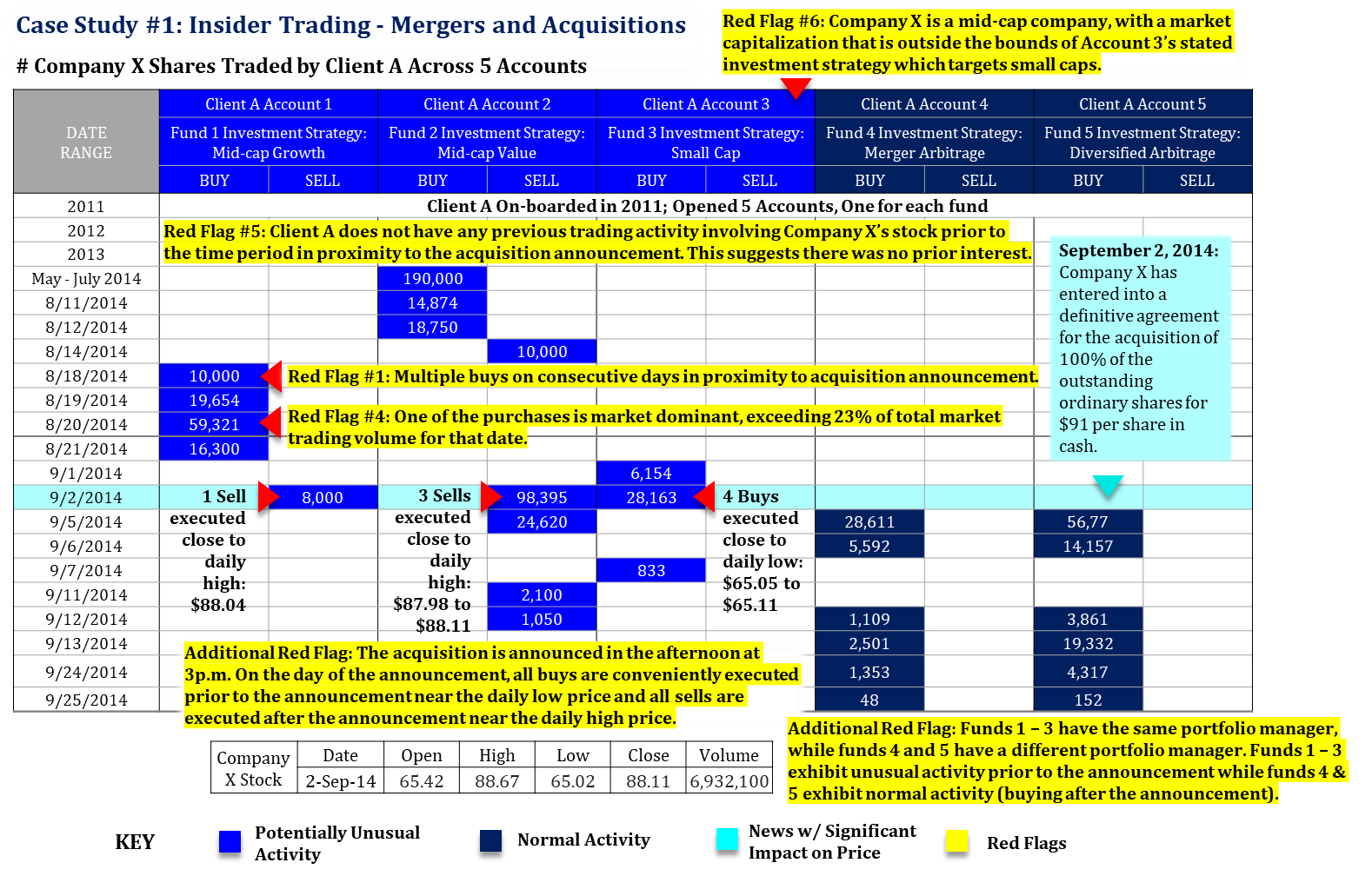

Aml In Capital Markets Insider Trading Acams Today

Archax Becomes First Uk Fca Regulated Digital Securities Exchange Decrypt

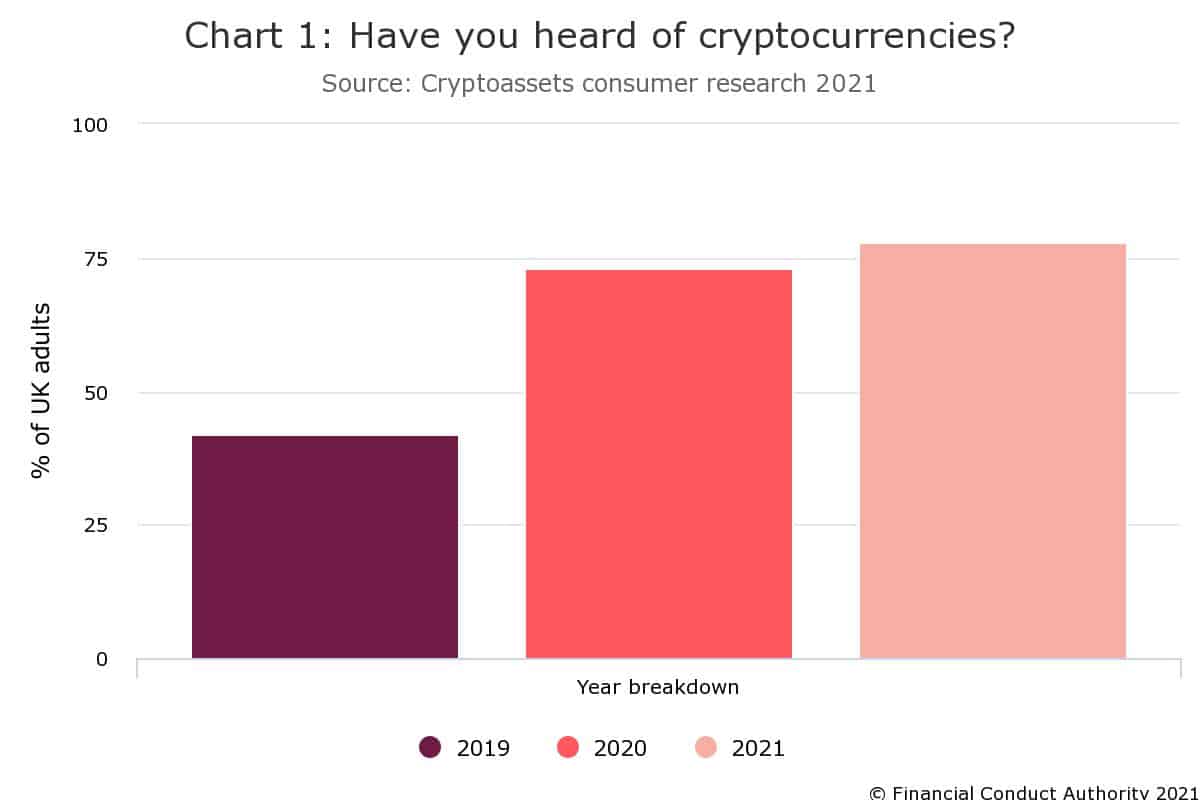

Uk Financial Conduct Authority More People Hold Crypto Now

Aml In Capital Markets Insider Trading Acams Today

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Aml In Capital Markets Insider Trading Acams Today

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Fca Fines London Boutique Investment Bank For Failing To Spot Financial Crime Relating To Cum Ex Trading Cityam Cityam

Fca Formally Announces Intended Cessation Dates For Libor

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Aml Systems And Controls An Ever Increasing Area Of Focus Ocorian

Fca Money Laundering Thematic Identifies Risk In Capital Markets Bovill

The world of regulations can seem to be a bowl of alphabet soup at times. US cash laundering rules aren't any exception. We have now compiled a list of the top ten money laundering acronyms and their definitions. TMP Risk is consulting agency focused on defending monetary companies by decreasing risk, fraud and losses. We've got big financial institution expertise in operational and regulatory threat. We now have a powerful background in program management, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many adverse consequences to the organization because of the dangers it presents. It increases the probability of major risks and the chance price of the financial institution and in the end causes the bank to face losses.

Comments

Post a Comment